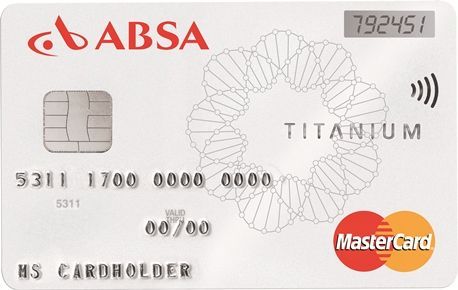

The Absa Mastercard Titanium Credit Card is an exclusive credit card option designed to provide premium benefits to its users. With a sleek design and a variety of advanced features, this card is a sophisticated choice for those seeking an elevated financial experience.

From enhanced rewards to premium services, the Absa Mastercard Titanium Credit Card stands out for delivering convenience and style to its cardholders.

Main information about the Absa Mastercard Titanium Credit Card

The Absa Mastercard Titanium Credit Card is a premium credit card option, offering a range of exclusive advantages to its holders. To apply for the card, it typically requires meeting a specific minimum income, ensuring that cardholders have the financial capability to make the most of the Titanium card’s associated benefits.

With the Mastercard brand, the Titanium card provides global acceptance, allowing users to use it at a wide variety of establishments worldwide. This broad acceptance not only increases convenience but also provides access to exclusive benefits and special promotions associated with the Mastercard network.

Before the approval of the Absa Mastercard Titanium Credit Card, it’s common for a credit check to be conducted to assess the financial situation of the applicant. A good credit score typically contributes to easier approval, ensuring that cardholders can fully enjoy its premium features.

One of the interesting advantages of the Absa Mastercard Titanium Credit Card is the set of premium benefits offered. This may include access to VIP lounges at airports, travel insurance, exclusive rewards programs, travel assistance, and concierge services.

These features add significant value to the cardholder’s experience, making the Titanium card an appealing choice for those seeking more than just credit card transactions.

Furthermore, the Absa Mastercard Titanium Credit Card often provides cashback programs or discounts on selected purchases, giving users additional opportunities to save while enjoying a more exclusive and convenient lifestyle.

Requirements for obtaining the Absa Mastercard Titanium Credit Card

The specific requirements for obtaining the Absa Mastercard Titanium Credit Card may vary, and it’s important to check with Absa or the issuing bank for the most accurate and up-to-date information. However, common requirements typically include:

- Minimum income: Applicants may need to demonstrate a minimum income to be eligible for the Absa Mastercard Titanium Credit Card. This ensures that cardholders have the financial means to manage the premium features associated with the Titanium card.

- Credit history: A positive credit history is often preferred. The issuing bank may conduct a credit check to assess the applicant’s creditworthiness. A good credit score can increase the chances of approval.

- Age: Applicants are generally required to be a certain age, typically 18 or older, to apply for a credit card.

- Identification documents: Valid identification documents such as a passport or driver’s license are usually required for the application process.

How to apply

- Research and choose Absa: Visit the Absa official website or contact Absa directly to gather information about the Absa Mastercard Titanium Credit Card, including its features, benefits, and terms.

- Check eligibility: Review the eligibility criteria to ensure you meet the necessary requirements, including minimum income, credit history, and age.

- Gather required documents: Collect the necessary documents, including proof of identity (passport, driver’s license), proof of address (utility bill, bank statement), proof of income (pay stubs, tax returns), and any other documents specified by Absa.

- Complete the application form: Obtain the Absa Mastercard Titanium Credit Card application form. This may be available online or at a local Absa branch. Fill out the form accurately and thoroughly.

- Submit application: Submit the completed application form along with the required documents through the designated channels. This can often be done online, in person at an Absa branch, or through other specified methods.

- Credit check: Be prepared for Absa to conduct a credit check as part of the application process. A positive credit history can enhance the likelihood of approval.

- Wait for approval: After submitting the application, wait for Absa’s response. The processing time varies, and you may receive approval, conditional approval, or a request for additional information.

- Receive and activate the card: If approved, you will receive the Absa Mastercard Titanium Credit Card by mail. Follow the instructions provided to activate the card, usually by calling a specified number.

- Start using the card: Once activated, you can start using your Absa Mastercard Titanium Credit Card to make purchases and take advantage of its premium features.

Always carefully review the terms and conditions associated with the credit card, and don’t hesitate to contact Absa directly if you have specific questions or concerns during the application process.