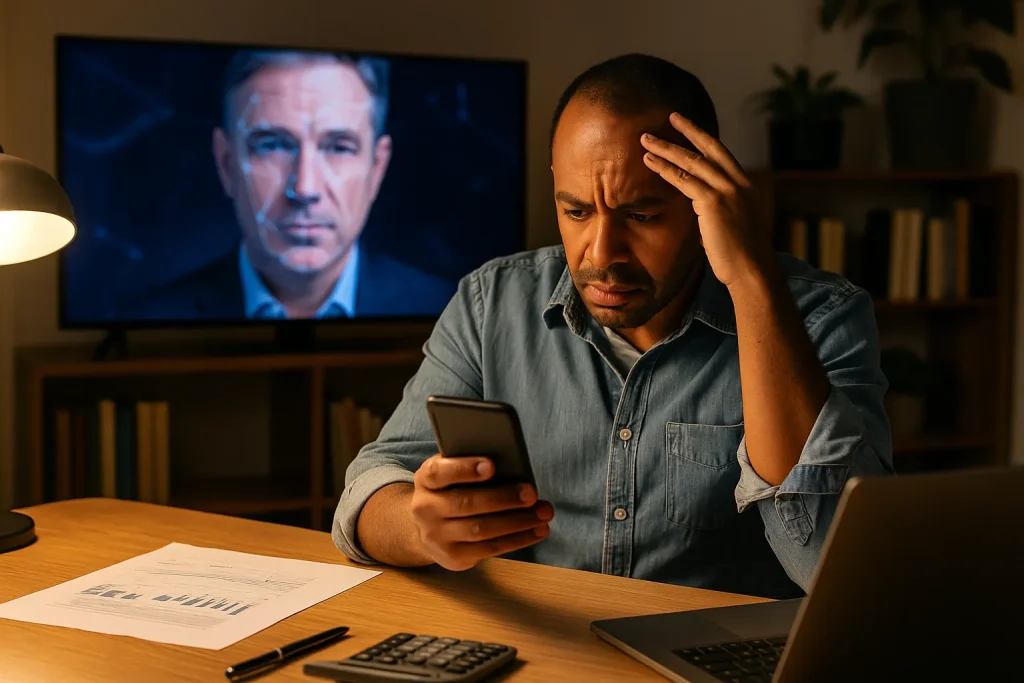

In the digital age, deepfake financial scams have emerged as a significant threat, particularly in South Africa. These schemes leverage artificial intelligence to create deceptive content, targeting unsuspecting individuals and businesses. It’s crucial to stay informed and cautious to protect yourself from these sophisticated cyber threats.

As deepfake technology advances, it becomes increasingly challenging to distinguish between authentic and fraudulent communications. Scammers use this technology to impersonate executives, manipulate voices, and even forge facial appearances in videos. Understanding the risks associated with deepfake scams is vital to protect your finances.

Understanding deepfake technology and its risks

Deepfake technology, powered by artificial intelligence, allows users to create highly realistic but fake digital content. In the context of financial scams, this means crafting convincing videos or audio recordings to deceive targets. Scammers often impersonate trusted figures or authorities to persuade individuals to transfer funds or disclose sensitive information.

Common tactics include manipulating video calls and creating fake audio messages from CEOs or financial advisors. By understanding these methods, you can better scrutinize unexpected requests and verify the authenticity of communications. It’s essential to remain vigilant and question any unusual or urgent demands for money or personal details.

Identifying signs of deepfake scams

Detecting deepfake financial scams involves paying attention to subtle signs that something is amiss. Look for discrepancies in videos, such as unnatural facial movements or mismatched lip-syncing. Unusual audio quality or abrupt speech patterns in recordings can also be red flags. If you receive a suspicious message, verify it through a known communication channel to ensure it’s legitimate.

Moreover, scammers may employ pressure tactics, insisting on immediate action to transfer funds. Educate yourself about these psychological tactics to better resist them. Discussing potential scams with colleagues or family can also provide additional perspectives before making any decision. With these insights, you can take proactive measures to protect yourself and your finances.

Tactics to safeguard against financial scams

Protecting yourself from deepfake financial scams in South Africa involves a combination of technology and common sense. Regularly update your software to ensure you have the latest security patches. Employ multi-factor authentication on all financial accounts to add an extra layer of security. This method requires additional verification steps, making it harder for scammers to access your information.

Additionally, consider using AI-driven detection tools to identify deepfake content. These tools can analyze digital material, offering insights into its authenticity. Stay informed about the latest scam trends through credible sources and engage in security awareness training. By enhancing your knowledge and digital literacy, you strengthen your ability to detect and prevent potential threats.

Implementing practical protection strategies

Implementing practical strategies is key to defending against scams. Start by regularly reviewing financial statements for unusual transactions. This simple habit can help detect unauthorized activities early. Equally important is to establish a verification procedure for financial requests, especially those received via email or social media. This extra step ensures that any transaction is genuine before proceeding.

Encourage an open dialogue about potential scams within your community and workplace. Sharing experiences can prevent others from falling victim. Remember, no legitimate entity will pressure you into making immediate financial decisions without proper validation. With these protective measures, you can confidently navigate the digital landscape and protect yourself from deceptive scams.

Conclusion on safeguarding your finances

In conclusion, deepfake financial scams present a significant challenge in South Africa, but with the right knowledge and tools, you can effectively mitigate these risks. Staying informed about how deepfake technology operates and recognizing the signs of scams are crucial first steps. By adopting security best practices, both technological and behavioural, you can protect your financial well-being.

Ultimately, awareness and vigilance are your strongest allies in combating these scams. Engage in continuous learning about emerging threats, and don’t hesitate to seek professional advice when in doubt. With a thoughtful approach and proactive measures, you can secure your personal and financial information against even the most sophisticated digital deceptions.